For European businesses and for foreign businesses with operations in Europe, nowadays VAT is a subject of continuous concern. VAT in Europe is expected to experience radical changes and numerous challenges in the coming years.

Why? You may wonder. Following the global COVID pandemic, governments, and tax authorities need supplementary revenues to cover deficits. Plus, it’s time to take measures regarding the enormous sum of money the European countries lose yearly because of fraud and deficiencies in VAT collection systems.

The last EU report concerning the VAT gap indicates that EU countries lost about 134 billion euros in VAT revenues in 2019. The process updates and digitalization are expected to bring significant improvements in terms of VAT collection.

But what is VAT exactly?

Value Added Tax or VAT is a tax imposed on the value created at each level along the supply chain from production to the final sale. It is applicable to the vast majority of goods and services sold and bought in a country, thus it can be considered a consumption tax. And it is paid by the end buyer.

The VAT system is used by more than 160 countries across the globe and is predominant in Europe.

The Value Added Tax is:

- A flat rate established by the authorities.

- A general tax applied to virtually all commercial activities. Hence, there are exceptions when VAT tax does not apply. It’s usually the case of small businesses having an annual turnover inferior to a threshold established by the authorities in the respective country.

- An indirect tax, as is included in the price and is paid by the buyer to the seller.

- The value of the tax is a percentage of the price. And the total sum of the VAT paid by the final consumer is the sum of VATs paid at intermediary stages of the production flow.

- Collected fractionally. A VAT-registered business pays the difference between the VAT it charges to its clients and the VAT it pays to its suppliers.

- A sure and relatively simple way of generating revenues for a country’s government.

Why do all countries in the European Union implement the VAT system?

The first reason relies upon the need for a transparent and neutral tax system across countries, in order to have a functional and efficient common market in Europe. It needed a tax system to ensure neutrality and the same level of taxes at the export points. And the VAT system provides the certainty that the exports are tax-free and can easily prove it.

Not to mention that historically, VAT is a European creation. It was first introduced as a tax in France in 1954, even if the concept appeared in Germany about a century earlier.

Plus, studies led by the International Monetary Fund reveal that countries adopting the VAT system, in the long run, experience increased revenues and more efficiency.

How does VAT work in Europe and how is it charged?

Each company active in the European market has to collect VAT, even if its headquarters are outside Europe. All countries in Europe use the VAT system but have their own rates and rules to be respected.

If an European country has a 21% VAT rate, then the government will collect 21 % on each transaction that takes place in the supply chain, from raw material to final product.

This system requiring VAT payment at every stage provides insights into all transactions and holds everyone in the supply chain accountable for their own amount of VAT. Thus, it is meant to prevent fraud and tax evasion.

Value-added tax example

Here is a concrete example of how VAT in Europe is charged:

- A supermarket buys a number of fruits from a local producer priced at € 1,000. The country has a VAT rate of 21%. Consequently, the supermarket receives from the producer an invoice of € 1,210(€ 1,000 + € 210 VAT). The local producer will receive the money and pay €210 as VAT to the tax authority.

- The supermarket will pay the invoice (payable) of € 1,210 and will claim € 210 for this purchase at the tax authority.

- The supermarket will sell the fruits to its customers. The same quantity of fruits will be sold at a retail price of € 1,500. The supermarket will invoice the final consumers € 1,500 + € 315= € 1,815. The supermarket receives the money from its consumers and will pay € 315 to the tax authority.

- The VAT is added at the end for the total value and paid by the final consumer at the end of the chain.

VAT rates in Europe as of 2022

VAT rates in Europe vary by country and exact information can be found at the VAT tax authority of each country.

The European Union has a VAT directive that each member country has to translate into the national legislation. There are standard rules, but they may be implemented in different manners by the members.

EU directive indicates just the minimum levels that the VAT tax should have. And those are 15% for the standard VAT rate and 5% for the reduced level (this applies only to an established list of goods and services).

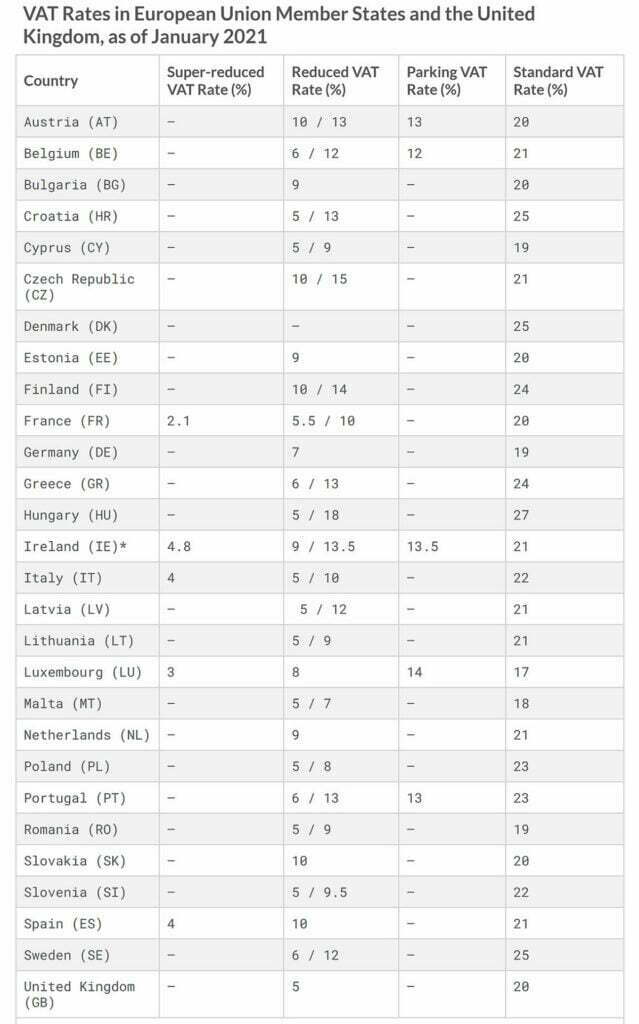

The list of VAT rates in Europe may be consulted below:

As one can notice above, Hungary has currently the highest VAT in Europe, established at a level of 27%. Croatia, Denmark, and Sweden are the next in the range with a VAT rate of 25%.

The lowest VAT in Europe belongs to Luxembourg with a VAT rate of 17%, closely followed by Malta with 18% and Cyprus, Germany, and Romania with 19%.

The average standard VAT rate across the EU is 21%.

Most European countries have reduced VAT rates and/or exemptions for a selection of goods and services based on the country’s current interests.

How to comply with VAT in Europe?

Even if rules concerning VAT in European countries differ, there are some steps that are common and can serve as a general guideline. The VAT rules you have to comply with depend on several aspects like:

- What products/services do you sell

- Who’s your customer – a business or a person

- Where is your company based

- Where is your client based

Register for VAT or VAT OSS

If selling goods and services in Europe you have to register for local VAT. Each European country has a threshold beyond which a company should register for VAT purposes. The thresholds are valid just for local businesses. Foreign businesses have to register for VAT no matter their turnover.

For example, local businesses in the Netherlands have to register for VAT and collect it, if their annual revenues surpass the level of € 20,000. In France, if their revenues are over € 85,800 while selling goods and over € 34,400 while selling services. In Germany, for revenues over € 22,000.

While registering for VAT purposes, the company will receive a VAT identification number. It’s a number that has between 4 and 15 digits and includes the country code, FR for France, NL for the Netherlands. This VAT ID is to be included on invoices and needs to be collected when invoicing to a VAT-registered business.

B2C European businesses selling their goods in other European countries are allowed to collect the VAT rate of their country of residence until the level of € 10.000. Beyond this amount, the company has to collect the VAT rate of the customer’s country of residence. Businesses outside the EU are not included in this exception.

VAT One Stop Shop (VAT OSS)

VAT OSS is a scheme conceived to simplify the VAT collection and payment among the countries inside the EU. It applies to businesses selling to private persons in multiple European countries. And it allows a company to register and file just one VAT OSS return in one country instead of registering and filing 27 VAT returns for all countries.

Non-EU businesses have the option to register for the VAT OSS Non-Union program, only if they sell digital products to private persons. They may choose any country for this, but usually, they prefer the country where they have the largest number of clients or one with a friendly registration infrastructure.

Calculate VAT

Determining the VAT on a transaction depends on several things:

- Who’s your customer? A private individual or a business?

- VAT for which country should you collect?

- Which VAT rate do you need to collect?

If you have businesses as customers, they should provide their VAT ID number. To avoid fraud, you have the possibility to verify your business partner in the VAT Information Exchange System (VIES) portal.

Most often for B2B sales (if you are a European business selling to other European countries) your business will not be required to pay VAT in Europe. Either because the zero VAT rate applies or because the reverse charge principle applies.

Establishing for which country you should collect the VAT is a rather complex process that needs to respect a rigorous set of rules referring to various factors like:

- Type of service/good.

- Type of client (business or private person).

- The delivery country from where the goods are shipped.

- The receiving country where the goods should be sold.

Gather evidence of buyer location

Taking into consideration that the VAT rate depends on the buyer’s location, as a business you are required to provide proof of your customer’s location.

For digital products, you need two proofs that confirm the client’s address. To confirm that the correct VAT rate was applied and charged you need to collect two of the following details: physical address, IP address, bank location, or country that issued the payment card.

The exception to this rule applies to businesses that sell a volume of digital products inferior to 100.000€. They will need just one of the data listed above.

According to the EU laws, these records should be kept for ten years.

File VAT returns

To be compliant, a business has to file a VAT return. It’s of utmost importance to submit the VAT returns in time, even if the company doesn’t have VAT to reclaim or pay.

The report has to include two types of VAT:

- Collected VAT (output VAT) meaning the VAT amounts charged to clients.

- Deductible VAT (input VAT) meaning the VAT amounts paid to suppliers.

The VAT declaration should also include the difference between the collected and deductible VAT and that’s the amount of VAT the business has to pay to the tax authority.

The filing frequency and the content of the VAT return form vary among the European countries and usually depend also on the annual turnover. Most often the filing period is quarterly.

Failing to submit correct and in due time VAT returns is subject to fines and penalties in each country where the business was supposed to pay and collect VAT. For example, filing a late VAT declaration in Germany attracts a penalty of 10% of the VAT amount, capped at € 25,000.

What does the future bring for VAT reporting?

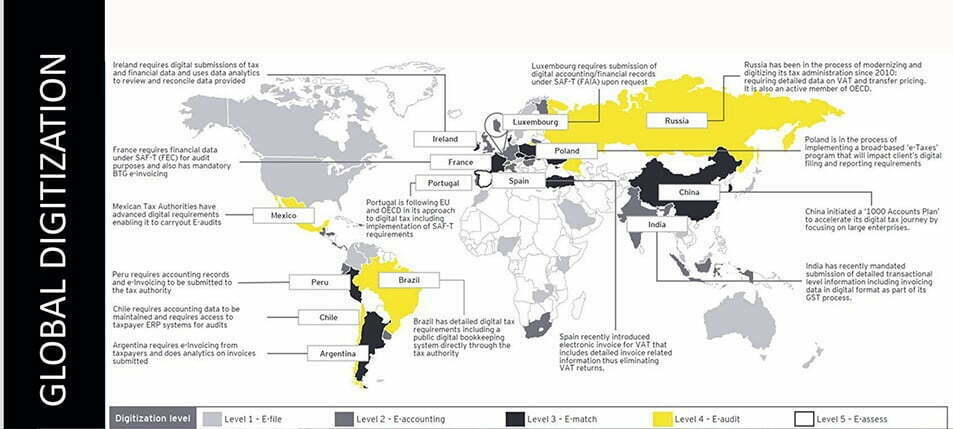

The most important factor that will heavily impact the VAT systems in the near future and in decades to come is the digitalization of the whole tax process. The migration toward digital already started in various degrees in European countries. Since the VAT is a tax that quickly and easily generates money for the governments, VAT is the first in line to become digital.

Hence, the final goal is to have better control over input data, reduce VAT frauds, shrink the VAT gap to a minimum and collect more money for the national budgets. All this will be done via digitalization.

Today, in most countries, companies gather their financial data, process it, and present it to the authorities in the form of declarations. In the future, the process will be reversed. The tax authorities will have access to all company data, will calculate the taxes, and inform the companies about the VAT amount they have to pay.

For example, in Italy, now when a company makes a VAT invoice for a customer, they don’t send it to the customer directly. They send the invoice to the tax authorities, and the client enters into the system and takes his invoice after validation. After introducing this system, the revenues from VAT improved by six billion euros, while the expectations were somewhere around 2 billion euros. France will introduce the same requirement starting on January 1, 2024.

Consequently, the easiest way to improve VAT revenues is via digitalization and making it mandatory for the companies to file all data with the tax authorities.

Thus, soon, there will be an enormous quantity of data exchanged between companies and government authorities. For instance, in Spain, all companies with a turnover of over 6 million euros have to enter and validate their VAT-related transactions with the tax authorities within 4 days.

The most advanced European countries in terms of tax digitalization are Italy, Hungary, Spain, and the UK (the Make Tax Digital program). The others are following at their own pace.

Another direction of action at the European level will be to have a unique European tax system called One Stop Shop (EU-OSS). Meaning companies will report their accounting data to one tax authority within the European Union and after that, the countries will reconcile balances among them.

The EU-OSS is not operational yet because of various challenges that Europe had to face in recent years like the 2008 financial crisis, the COVID crisis, the war in Ukraine, and political divergences.

Challenges caused by VAT in Europe for businesses

The advent of digitalization and the VAT regulations that become stricter and more granular, bring challenges for businesses as they need to comply with and respect harsher requirements.

Some of these are:

- Constantly changing VAT regulations in European countries, accompanied by stricter requirements for compiling returns make it increasingly difficult for businesses to be and remain compliant. They need to establish a more performant technical infrastructure, supplementary human resources, and budgets to accommodate all the changes in due time. For example, as of January 2021, Hungary requires all B2B and B2C transactions to be reported in real-time.

- The automation factor struggles to keep up with the ever-changing VAT regulations. Since more and more countries are on the verge of requiring all invoice-related information to be submitted to the tax authorities already validated and within 24 hours, automating the process is vital. Plus, complying with harsher security rules.

- Processing manually, in Excel, the changes in the VAT rules for each country is highly time-consuming and subject to human errors. As tax authorities ask for more and more data, delivered in a short period of time, it will be literally impossible to continue with the manual path.

- Manual processing of VAT fillings is quite often accompanied by mistakes and non-compliance. Mistakes that are difficult to find and rectify and always delay the reporting phase.

- Complexity creates premises for further errors. Companies active in multiple European countries face increased difficulties and more complex situations as they must file the tax return for each country.

- International companies see their accounting costs increase as they have either to hire local service providers in each country or hire teams of local experts.

- The company holds full responsibility if the tax authorities revert the declarations with feedback and they have to make the corrections. As the service providers do not check the input for errors, they only act as a middleman.

- VAT declarations with errors are difficult to correct and with a higher risk of getting fines and penalties from competent authorities.

How can itax4apps fix most of these challenges?

Itax4apps is a state-of-the-art solution for your VAT processes within the EU and outside the EU. It’s a strong, user-friendly software app ready to facilitate your VAT-related activities and relieve the VAT reporting burden on your business.

Itax4apps streamlines the VAT-related manual processes to a minimum, reducing the pressure on your human resources, and reducing the errors that inherently appear when manipulating large amounts of data in Excel.

It’s a solution that interconnects with your ERP system, automatically imports all the needed data and highlights it in the corresponding form. The errors are marked in red and the only thing that your tax specialists have to do is correct the red cases and the differences.

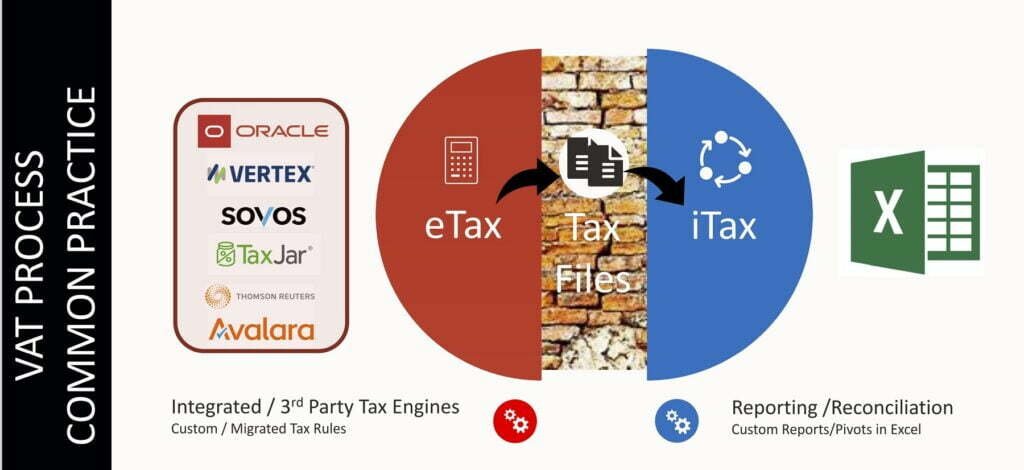

Commonly, the VAT process looks like this:

- Gather data in large Excel files.

- Send all the data to a third party if you have the tax service externalized.

- Have an internal specialist/a team of specialists/an external provider work through that amount of data.

- Compile it and put it in the right format for the VAT returns.

- Send the VAT returns to the tax authorities.

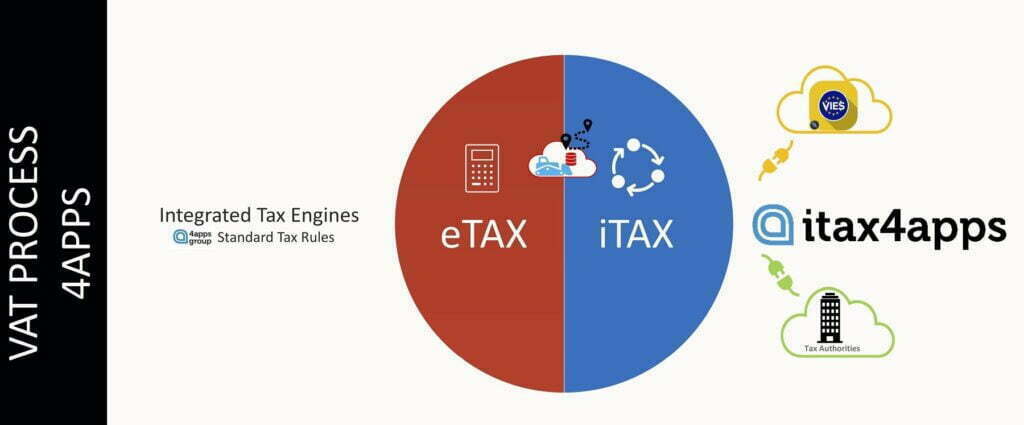

With an advanced solution like itax4apps, your VAT process shifts to this:

- Data from the ERP system is automatically imported.

- Data is processed automatically via your business’s personalized VAT flow defined when integrating itax4apps.

- Tax specialist(s)/external provider verifies and corrects the errors highlighted in red with a few clicks.

- Tax reports are sent to the competent authorities with a click of a button.

Itax4apps is hosted in the cloud, where it can easily be accessed by the persons who need them. And the company is always in control of its data. Thus, no transfers of large documents via third party services, no back and forth of documents if declarations are incorrect.

Plus, with itax4apps the data cannot be manipulated. Only the input data can be changed, but not the data during the flow. Thus, all the in-force security and data regulations are respected.

Practically, itax4apps is an add-on to your ERP system, that reflects the data in near real-time.

In a nutshell, inside the solution, you can do VAT analysis, reconciliation, compliance, checks, etc. while owning all the data and controlling all its security. Itax4apps integrates with the tax authorities (those that currently offer this possibility) and is responsible for keeping the solution up to date with authorities’ new requirements.

For compliance purposes, using a solution like itax4apps is a better way to cover the business needs. Better use of human resources, centralized VAT declarations, and filing.

Practically, you have a single procedure at your disposal for correcting the errors related to VAT in Europe for 10 or 20 countries, and one person can be in charge of them all. He just needs to correct the red cases. If everything is green in the app you can send the declarations with full confidence to the authorities.