The value-added tax is arguably the consumption tax with the highest impact on the economy. It is used in over 160 countries across the globe and contributes heavily to public revenues (over 30%). Consequently, VAT compliance is of paramount importance for most governments.

What is VAT compliance? And why do you need it?

VAT compliance is the process realized by a business to ensure it files the VAT returns correctly according to the rules imposed by the tax authority in a certain country.

For many companies and their financial teams, complying with VAT is a complex and continuous saga. International companies that have to be compliant in multiple jurisdictions face even harsher situations. And it’s fairly easy to skip on important details that may attract non-compliance issues and legal consequences with the VAT authorities.

VAT non-compliance may have a vital impact on a business’s profitability and that’s why most businesses do their best to prove they are compliant.

Non complying with VAT regulations may incur the following risks:

- Administrative fines.

- Sanctions under criminal law.

- Extensive audits from authorities that have huge costs in terms of resources and time.

- Rollover effects on other accounting or tax-related domains.

- Audits for business partners that may affect business relations.

- International audit procedures implying tax authorities from other countries.

- Lose the right to deduct VAT.

- Obligation to cover VAT for invoices considered fraudulent.

- The implementation of CTC (Continuous Transaction Control) is expected to execute faster VAT compliance checks and detect quicker non-compliance issues. And thus, the consequences of non-compliance will get tougher.

VAT compliance statistics and trends

Even if the guiding principles concerning the VAT are more or less the same for all countries, in reality, the rules and requirements have been implemented in a large variety of forms. And as a consequence, the compliance burden on companies varies largely across the world.

According to the Paying Taxes study of PWC, the average annual time needed to comply with VAT for Swiss companies involved in the study was 8 hours or one working day. While for Brazilian companies it was 1,189 hours or almost 30 weeks of work.

The time needed for VAT compliance varies largely also among states with similar VAT systems and comparable levels of development like the European countries. In Luxembourg, VAT compliance activities sum up to 22 hours, on average, per year, while in Bulgaria are needed 165 hours per year.

Numbers show that in developed economies, less time is required to comply with VAT rules. Plus, in countries that have implemented digital pay and file for VAT, companies spend on average 27% less time to accomplish their VAT obligations.

According to the European Parliament study “VAT gap, reduced VAT rates and their impact on compliance costs for businesses and on consumers” digitalization has a major impact on shrinking tax compliance costs. By facilitating the completion of forms and payments online and record-keeping.

In Europe, from 2006 until 2020 the average time necessary to complete compliance tasks decreased from 473 hours to 225 hours a year. Arguably, the companies will see the improving effects of digitalization on compliance costs, in the long run. In the short term, they will most probably experience increased costs, mainly if they lack digital capabilities.

But, if digitalization will not simplify things for the companies, the benefits will most likely be limited.

VAT compliance trends

The tax system will become more and more complex, as tax authorities will require more data to be reported in a shorter time, or even in near real-time.

The manual intervention will diminish day passing or otherwise, it will be impossible to comply with VAT regulations in due time.

CoContinuous Transaction Controls (CTCs) approaches will proliferate, thanks to the positive results obtained by the countries that already implemented such systems.

VAT to be charged at destination for some cross-border trades of low-priced goods and digital services.

VAT OSS – the European system put in place to simplify the VAT declarations in Europe to become the norm. The trend is that businesses register and pay VAT in one EU country and the authorities will reconcile the amounts due among them.

Aggregator liability – authorities will require platforms that process a large number of transactions like transaction management cloud providers or e-commerce marketplaces to report such data directly to the tax authorities. And potentially even paying the taxes in their clients’ name.

E-accounting followed by e-assessment – in the future, the tax authorities will prefill businesses’ VAT returns based on the business’s own integrated data system, to which the authorities will have access.

Is there a VAT compliance checklist that could be used?

The straight answer is NO. There is no such thing as a VAT compliance checklist that could apply to most businesses, no one-fits-all procedure. And the main reason is that each company has its own processes. What may be a good fit for one company, will not fit another.

Because there are situations when the transactions are highly complex involving stocks that are cross-border, supply chains with internal documents, transfer pricing, etc. A tax expert is needed to decide how to determine the VAT and if it is correct. And that for each jurisdiction.

But there are tools that can help greatly with global VAT compliance.

Reporting solutions like itax4apps are designed to determine almost automatically the VAT and if the tax was correctly calculated. Based on the input, a data flow is created that generates the calculations and returns. It includes the code of the transaction, the tax code, and all the details required for the respective transaction.

Next is a verification phase, where the result is checked automatically and if compliance is achieved. If there are issues or errors in the data flow, those transactions will be highlighted and tax specialist intervention is needed to correct them.

Why does your business need powerful VAT compliance software?

To reduce costs in terms of time and resources. Collect and manage your tax data via digitization and automation to shrink the number of working days needed for VAT compliance.

To automate and fasten complicated VAT and other taxes calculations. Performing advanced calculations like Partial Exemption Special Method can be cumbersome for most businesses. Using a performant software application to make the calculus for you with just the input of data source, is a great time saver and drastically diminishes the risks of human errors.

To shrink Excel sheet dependency and minimize the risk of error. Automation offers fast and easy ways to manipulate the data, via checks, filters, and allocations. Plus, it reduces the number of data points that are needed.

To perform analysis. Accessing large amounts of data in user-friendly dashboards, one can compare specific operations, and specific periods and make more accurate projections and forecasts.

To facilitate data checks and error corrections. A VAT software solution provides a tested and updated data flow and imports raw data, fills the returns as per procedures, and highlights the errors and anomalies. Meanwhile fastening the error correction process.

To create online audit trails for compliance. A digital VAT process allows finance teams to efficiently answer tax authorities’ inquiries if the case.

To strengthen your business’s position for the future. As massive changes are on the way concerning VAT reporting, companies should implement the right technology to help them stay compliant no matter what requirements will appear.

To ensure a path to a “single source of truth”. The tax technology is expected to simplify the tax processes and use a similar set of data to automatically make the tax calculations.

To avoid fines and penalties – a reliable VAT software solution will calculate the returns and file them without error. Thus, streamlining the risk of fines and other legal consequences.

How can itax4apps help your business with VAT compliance?

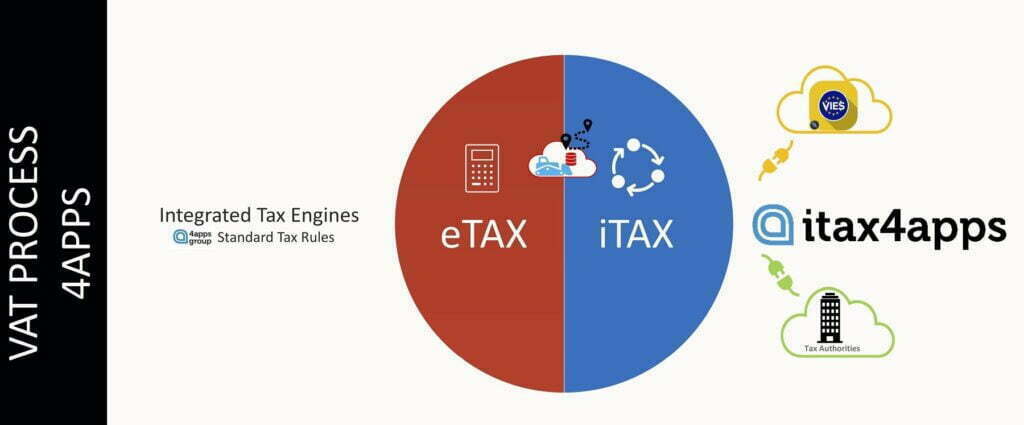

itax4apps is an Oracle-based solution designed to relieve the VAT compliance burden on your business.

It has three major advantages, it is a “single source of truth” app, meaning you cannot manipulate the data within the flow, just the input can be modified. And it shows you in a couple of clicks if your transactions are compliant, based on the compliance rules defined in the flow. Plus, you have the ability to do compliance checks on a large variety of data, just by changing some filters.

Etax4apps (4apps’s service-based component) standardizes all elements that can be standardized, the transaction types, the tax rates, the tax codes, etc. It defines the tax regimes, the rate levels, and the codes that should be used as a minimum. Then it designs the flows and the outputs of the flow with codes.

Most often etax4apps is able to standardize 80-90% of a company’s flow, the rest being implemented with the advice of a tax expert. Putting in place an automated system for VAT compliance needs the collaboration of a tax expert. After that, the flow is updated accordingly.

The reports will be based on the flow and the expected outcome. So, you can see your tax determination flow, how the tax is calculated and whether it’s calculated in the right manner. Moreover, here you can see if the transaction has the correct VAT rate, if not you can click on it and check where the error is.

This is a flow following parameters on a transaction, or on a customer, or on a supplier. If by any chance the information is missing or is incorrect, it is not following the flow anymore and it’s flagged as incorrect.

Practically what you check when you run a report is if the transaction follows the flow and if not you can check it backward to identify the error.

In such conditions, with the right tool, VAT compliance is a very manageable task and facilitates your financial team’s efforts of being tax compliant.

If you want to know more about VAT compliance and our itax4apps software to make it easier to be compliant, feel free to contact us.