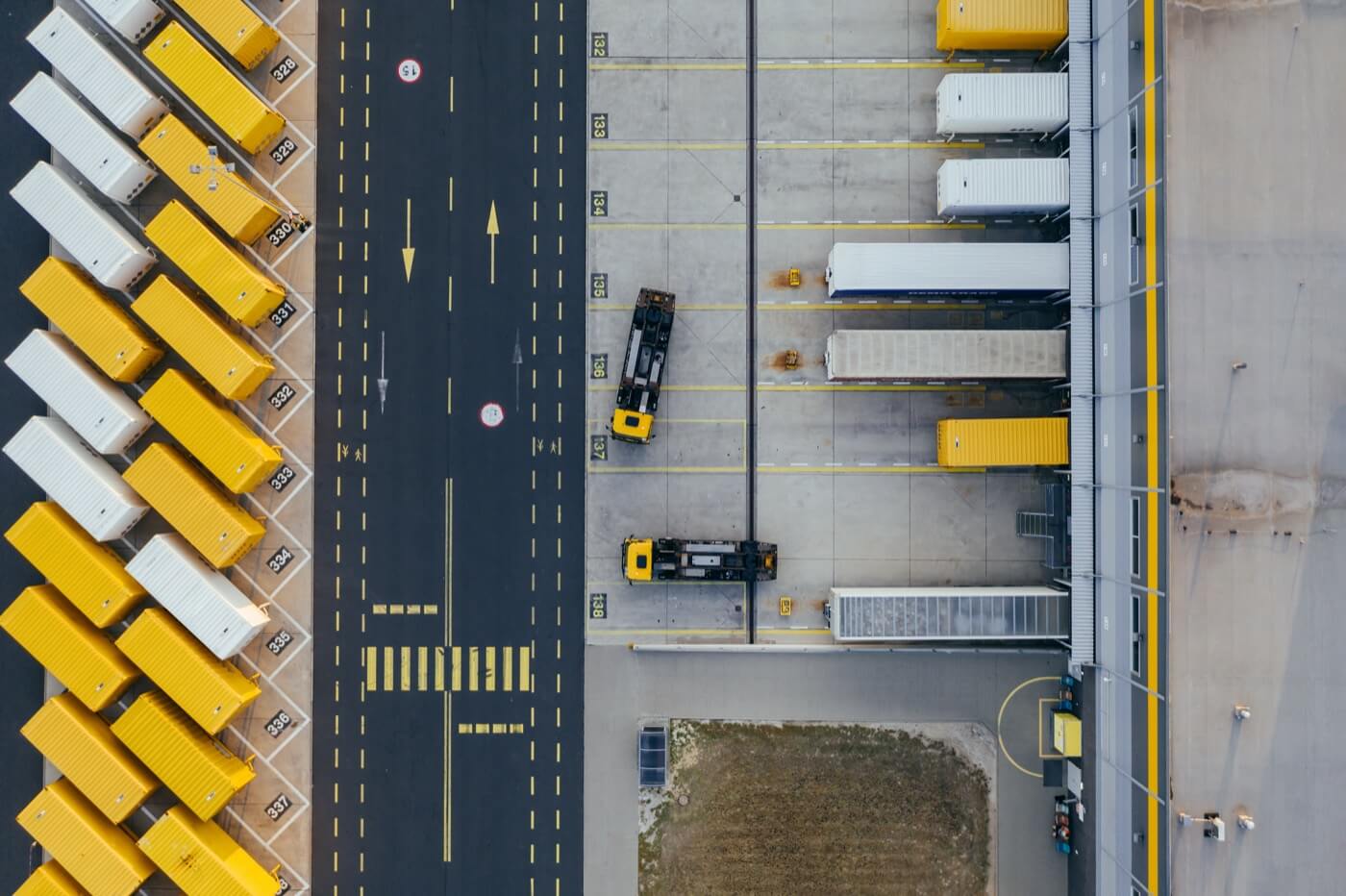

Indirect tax reconciliation

Excelling without Excel

Getting all the numbers right for periodic and annual VAT declarations and reporting is a hell of a job. Especially when you’re still struggling with Excel and its many flaws to come up with a watertight tax reconciliation. Just ask your Tax or Finance Manager. With itax4apps you can simply drill down directly to detailed information right from the VAT summary statements, even to the level of the invoice or invoice scan.