Fasten your seatbelts! We are going on a holiday. And we all buckle up, since we all want to arrive safely at our vacation destiny. It is a legal obligation which has become a habit… and we are creatures of habit. If it was voluntary, it wouldn’t become a habit. But that is exactly what should happen in the case of VAT validation via VIES.

What is VIES?

The VAT Information Exchange System (VIES) is a digital way of validating VAT-identification numbers for economic entities registered in the European Union (EU) for cross border transactions on goods or services. EU law requires that, where goods or services are procured within the EU, VAT must be paid only in the member state where the purchaser resides. Therefore, suppliers benefit by being able to validate the VAT numbers of their customers. This validation is performed through VIES.

Is VAT identification mandatory?

Validating the VAT Registration Number (VRN) of a customer with whom you perform cross-border trading within the EU, allows you to consider this type of sales as a zero-rated Intra-Community sale. This means that you do not have to charge and pay VAT for this type of transaction. This validation is not mandatory as we speak, but the next big thing looming on the horizon is the new EU proposal to make the VAT identification mandatory in case you transfer goods to another company in another EU country (expected as of 2020). The absence of the right VRN will most probably make the selling party liable for the VAT. This is not something you want to rack your brains over when you go on a vacation, right?

Bulk VIES validation

You can overcome this by constantly check and update your customer data with the right VAT registration data from the VIES. Using the site of the European Commission you can do this one by one, but that is not how you want this to be done. We strongly believe that VIES validation should be done in large numbers instead to save your staff valuable time. And that bulk validation should be integrated in the tool/software you use to declare VAT. If that would be all, VIES validation would then become a simple repetitive task. But this only half the story.

The impact on customer data management

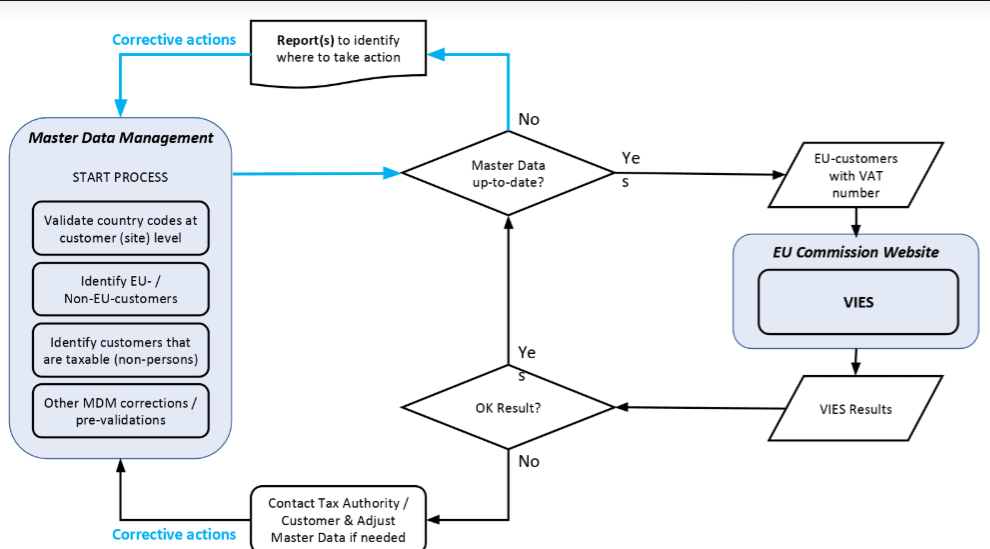

With the introduction of VIES, you might tend to overlook the impact it has on Master Data Management. Only clean and relevant data will be accepted during VIES validation. So how sure are you that your customers all have the correct country codes? Or that you can easily identify your relevant EU-customers from other, non-relevant customers? Are you even sure that your EU-customers all have a registered VAT Registration Number in your financial system(s)?

We pose these questions to show that the management of your customer data in order to use VIES may be the most difficult and time-consuming task on your part. Any support from a Tax application for the identification of shortcomings in your customer data will be very welcome and something that is not to be overlooked. The picture below emphasizes the importance of proper customer data management.

So regardless the fact whether something is voluntary or obligatory, it’s nice to know you have some sort of seatbelt in place and you can enjoy your vacation. Happy Holidays….

Do you want to know more about how to realize VIES validation as described or do you simply want a happy holiday postcard to brighten your day, you can contact us.

You can also mail or call Henk Tiesma directly: h.tiesma@4apps.com / +31 646 178 187.